It usually gets added to your monthly mortgage payment and equals 0. 5% to 1% of the quantity of your home loan. For example, with a $150,000 home mortgage, you'll normally be taking a look at $750 to $1,500 in PMI annually, expanded over 12 months.

Unless you can buy your house totally in cash, finding the right residential or commercial property is only half the fight. The other half is selecting the finest type of home mortgage. You'll likely be paying back your home loan over a long duration of time, so it is necessary to discover a loan that meets your needs and budget.

The 2 primary parts of a home loan are principal, which is the loan amount, and the interest charged on that principal. The U.S. government does not work as a home loan lending institution, however it does guarantee certain types of home loan loans. The 6 main kinds of home loans are conventional, conforming, non-conforming, Federal Housing Administration-insured, U.S.

Department of Agriculture-insured. There are two parts to your home mortgage paymentprincipal and interest. Principal refers to the loan amount. Interest is an extra amount (determined as a portion of the principal) that lending institutions charge you for the privilege of obtaining cash that you can pay back gradually. During your home mortgage term, you pay in month-to-month installations based on an amortization schedule set by your loan provider.

What Is The Current Variable Rate For Mortgages for Dummies

APR consists of the rates of interest and other loan fees. Not all home loan products are created equivalent. Some have more strict standards than others. Some lenders might need a 20% deposit, while others require as little as 3% of the house's purchase rate. To get approved for some types of loans, you need pristine credit.

The U.S. federal government isn't a lending institution, however it does Learn more ensure specific types of loans that fulfill stringent eligibility requirements for earnings, loan limits, and geographical locations. Here's a rundown of various possible home loan. Fannie Mae and Freddie Mac are two government-sponsored business that purchase and sell the majority of the standard home loans in the U.S.

Borrowers with good credit, stable work and income histories, and the ability to make a 3% deposit can typically receive a traditional loan backed by Fannie Mae or Freddie Mac, two government-sponsored enterprises that purchase and sell most standard home mortgages in the United States. To avoid requiring private mortgage insurance coverage (PMI), debtors usually require to make a 20% down payment.

Adhering loans are bound by maximum loan limitations set by the federal government. These limits vary by geographical location. For 2021, the Federal Housing Financing Firm set the standard conforming loan limitation (CLL) at $548,250 for one-unit homes. However, the FHFA sets a greater optimum loan limitation in Click here for more specific parts of the country (for example, in New York City or San Francisco).

Getting The What Are The Lowest Interest bluegreen timeshare cancellation policy Rates For Mortgages To Work

The adhering mortgage loan limitation for a one-unit home in 2020. Non-conforming loans generally can't be offered or purchased by Fannie Mae and Freddie Mac, due to the loan amount or underwriting standards. Jumbo loans are the most common type of non-conforming loans. They're called jumbo because the loan quantities normally surpass adhering loan limits.

Low-to-moderate-income purchasers purchasing a home for the first time usually rely on loans insured by the Federal Housing Administration (FHA) when they can't certify for a conventional loan. Customers can put down as little as 3. 5% of the home's purchase rate. FHA loans have more-relaxed credit-score requirements than standard loans.

There is one disadvantage to FHA loans. All customers pay an upfront and yearly home loan insurance premium (MIP)a type of mortgage insurance coverage that safeguards the lending institution from customer defaultfor the loan's life time. FHA loans are best for low-to-moderate income debtors who can't receive a standard loan product or anybody who can not afford a substantial down payment.

5% deposit. The U.S. Department of Veterans Affairs guarantees home loans for qualified service members that need no down payment. The U.S. Department of Veterans Affairs (VA) guarantees house buyer loans for qualified military service members, veterans, and their partners. Customers can finance 100% of the loan quantity with no required down payment.

The What Are The Debt To Income Ratios For Mortgages Ideas

VA loans do require a funding charge, a portion of the loan quantity that helps balance out the expense to taxpayers. The funding fee differs depending on your military service category and loan quantity. The following service members do not have to pay the financing cost: Veterans receiving VA benefits for a service-related disabilityVeterans who would be entitled to VA compensation for a service-related impairment if they didn't receive retirement or active responsibility paySurviving spouses of veterans who died in service or from a service-related special needs VA loans are best for qualified active military personnel or veterans and their partners who desire highly competitive terms and a home mortgage item tailored to their financial requirements.

Department of Farming (USDA) assurances loans to assist make homeownership possible for low-income buyers in backwoods nationwide - what are today's interest rates on mortgages. These loans require little to no money down for certified debtors, as long as properties meet the USDA's eligibility guidelines. USDA loans are best for property buyers in eligible backwoods with lower family incomes, little cash conserved for a down payment, and can't otherwise qualify for a traditional loan product.

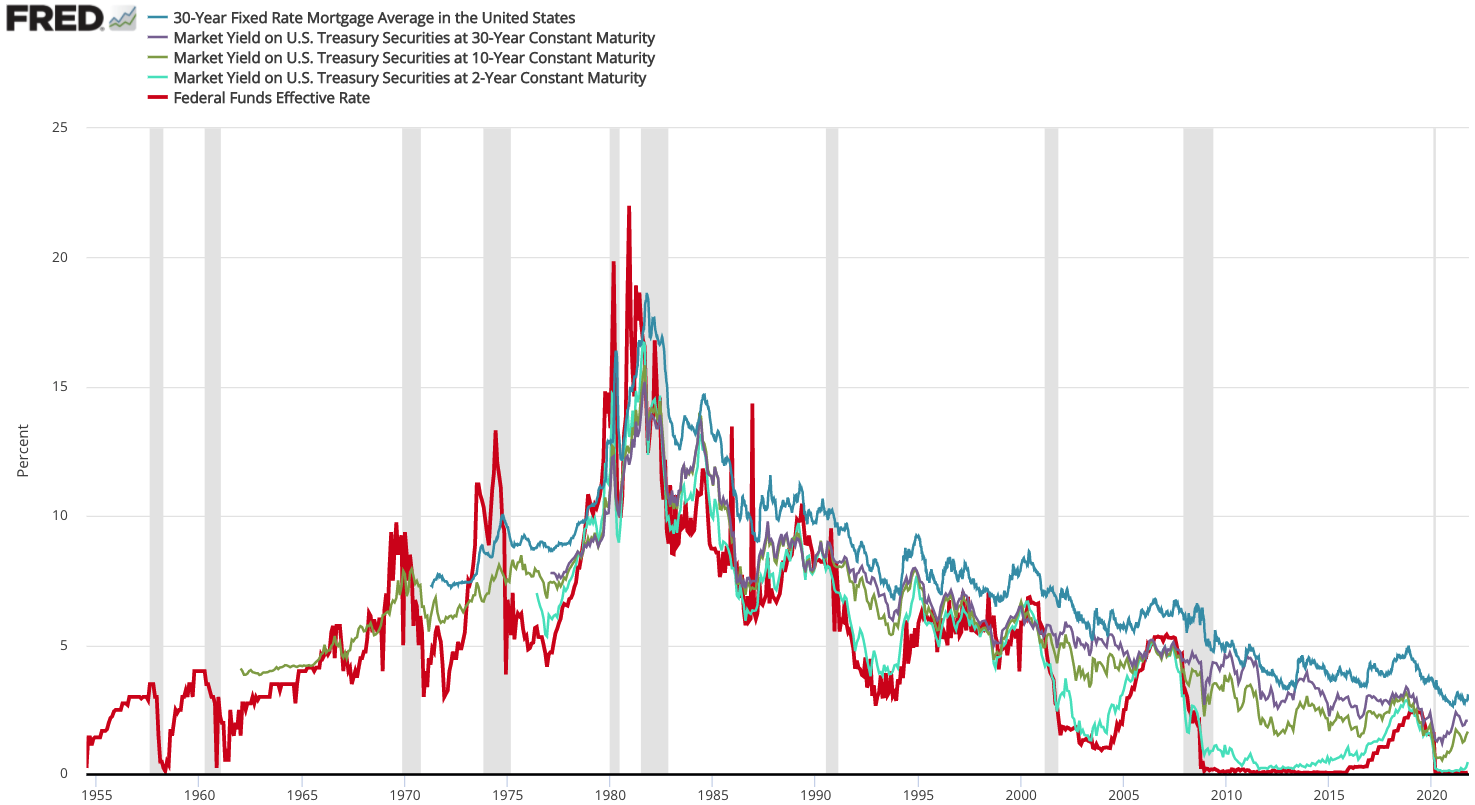

Mortgage terms, consisting of the length of payment, are a crucial factor in how a loan provider costs your loan and your rates of interest. Fixed-rate loans are what they seem like: A set rate of interest for the life of the loan, typically from 10 to 30 years. If you wish to settle your house faster and can pay for a higher month-to-month payment, a shorter-term fixed-rate loan (say 15 or twenty years) helps you shave off time and interest payments.

Choosing for a much shorter fixed-term home loan means regular monthly payments will be higher than with a longer-term loan. Crunch the numbers to guarantee your spending plan can manage the greater payments (what are interest rates today on mortgages). You might also want to factor in other goals, such as saving for retirement or an emergency fund. Fixed-rate loans are perfect for purchasers who prepare to stay put for numerous years.

Facts About What Is Home Equity Conversion Mortgages Uncovered

However, if you have the hunger for a little threat and the resources and discipline to pay your home loan off quicker, a 15-year fixed loan can save you significantly on interest and cut your payment duration in half. Variable-rate mortgages are riskier than fixed-rate ones however can make sense if you plan to sell the house or refinance the home loan in the near term.

These loans can be dangerous if you're not able to pay a higher regular monthly home mortgage payment once the rate resets. Some ARM items have a rate cap specifying that your month-to-month mortgage payment can not exceed a specific quantity. If so, crunch the numbers to make sure that you can possibly deal with any payment increases as much as that point.

ARMs are a strong option if you do not prepare to remain in a home beyond the initial fixed-rate period or know that you plan to re-finance prior to the loan resets. Why? Rates of interest for ARMs tend to be lower than repaired rates in the early years of payment, so you might possibly conserve countless dollars on interest payments in the preliminary years of homeownership.